In this article you will read:

1. Introduction

TSE opened in February 1967. During its first year of activity, only six companies were listed in TSE. Then Government bonds and certain State-baked certificate were traded in the market. The Tehran Stock Exchange has come a long way. Today TSE has evolved into an exciting and growing marketplace where individual and institutional investor trade securities of over 325 listed companies. The TSE enjoys a reputation for having maintained an orderly market and a cost-effective trading capability since its inception. The fully computerized trading system, which was launched in 1994, has helped boost the trading capacity and efficiency of the stock market. In 2007, the TSE moved to a more powerful trading system (powered by Atos Euronext) to meet the high trading volume. TSE has been awarded the quality system certificate of ISO9001 in 2009 and it is also planning to obtain the ISO27001 certification for its IT Security Management System.

2. Foreign Investments in the Tehran Stock Exchange

As with several emerging stock markets, the TSE historically set several limitations on foreign investment. With the growth of Iran’s stock market and development of the economy, the stock market authorities have gradually relaxed these limitations on foreign investors. Since April 2010, the process for investment by foreign investors in the stock market has been changed from the ‘permit’ system to the ‘repatriation’ system. On 18 April 2010, upon the recommendation of the Ministry of Economic Affairs and Finance, and by virtue of paragraph 3 of article 4 of the Securities Market Law ratified in 2005, the Council of Ministers approved “The Regulations Governing the Foreign Investment in the Exchanges and OTC Markets”. This has consequently simplified the application procedures for foreign investment in the TSE.

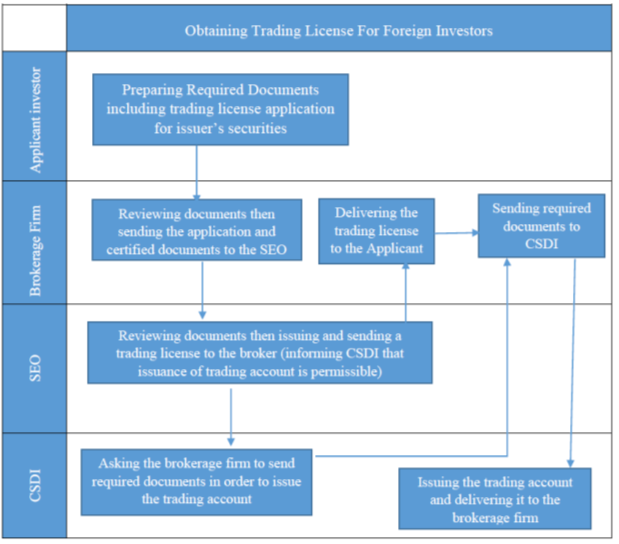

3. Obtaining Trading License for Foreign Investors

Foreign entities have to submit the required information and documents to the Securities Exchange Organization (SEO) along with an application based on the forms prescribed by the Organization so as to obtain a license for trading in securities on every exchange or OTC market.

Below chart shows the procedure of obtaining trading license for foreign investors:

4. Buying and Selling Stocks

The following steps should be taken when trading stocks on the TSE:

(i) Choose a stockbroker: In choosing a broker, you should check if that broker (person or corporation) is a member in good standing at the TSE. A complete listing of the TSE member-brokers can be found in various publications or from the TSE Membership Department.

(ii) Open a brokerage account: Once the investor has chosen his brokerage firm, a brokerage account has to be opened. This account allows the client to perform stock transactions (buy and sell shares) any time – similar to a bank account which enables you to deposit, transfer and withdraw money. Opening a brokerage account is relatively easy to accomplish and takes no longer than opening a bank account.

(iii) Place your order with your broker: After opening the account, a trader will be assigned to the investor. A trader is a licensed salesman who is authorized to buy and sell securities at the TSE. The assigned trader will be your contact person for all transactions. He/ she will receive your order, most likely by telephone (unless arrangements are made), and will execute the order through the trading terminal connected to the main system of the Exchange.

(iv) Settle your transaction: Buying and selling transactions are settled by book-entry. This means the ownership of shares and cash is transferred electronically to the brokerage account, without the stock certificates and cash being handed over physically. (Instead, stock certificates are simply immobilized and kept in a safe place – Central Securities Depository of Iran, Inc.) The account is credited when buying shares, and debited in the case of selling shares.

5. Global Relationship

TSE is a full member of World Federation of Exchanges (WFE), and also is a member and one of the founders of the Federation of Euro-Asian Stock Exchanges (FEAS) (since 1995), and also a subscriber of the International Corporate Governance Network (ICGN). The TSE is also an active participant of OIC Members’ Stock Exchange Forum.

6. Are Foreign Clients Allowed to Participate in IME Trades?

Iran Mercantile Exchange (IME) is a public joint stock company established under the Law of the Securities Market of Islamic Republic of Iran. There are three commodity categories traded on the IME spot platform including Agriculture, Metal and Mineral as well as Petrochemical products. Derivatives market of IME offers Gold Coin Futures and Options. Foreign participants including potential buyers and sellers are permitted to trade on IME. Non-Iranian producers are also allowed to offer and put their products on sale in the IME spot market. The commodity must be in conformity to the inventory of the listed products of the IME.

7. How to Place Order for Trading in IME?

Orders are given to brokers by the clients and the brokers having been ensured of payments and collaterals, post the orders in the trading system for matching and post trade processes. No direct order placing is possible with the exchange.

8. What Are the Exchange Trading Hours?

The trade timings of the Exchange from Saturday to Wednesday are IST 10:00 a.m to 15.30 p.m.

No comment